Taxing the Poor to Balance the Budget in Georgia

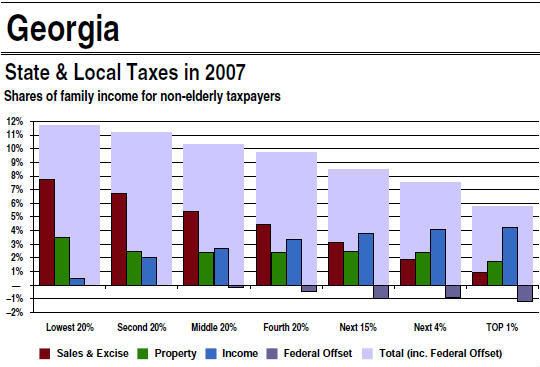

Yesterday, on the Ed Show, Ed Schultz did a segment on Georgia’s plan to raise taxes on Girl Scout cookies, at the same time as cutting corporate taxes. It’s not just Girl Scout cookies, of course, as it impacts sales taxes generally, and as Ed remarked, such taxes fall heaviest on low & middle families. This is particularly true in Georgia, as can be seen from the chart below, from the 2009 report, “Who Pays? from the Institute on Taxation and Economic Policy:

Doing a bit of math with the table that accompanies this chart in the report, we find that sales and excise taxes account for 7.8% out of the total 11.7% that the lowest-income 20% of Georgians pay in state and local taxes, meaning that sales taxes make up 67% (or 2/3rds) of all taxes that they pay. This compares to 0.9% out of the total 6.9% that the richest 1% of Georgians pay in taxes, meaning sales taxes make up just 13% of all taxes that they pay. So sales taxes are 5.1 times as big a portion of the taxes paid by those on the bottom, compared to those on the top.

Now, it’s not actually THAT bad, since the sales and excise tax total includes general sales, others sales & excise taxes and sales & excise taxes on businesses. The general sales tax portion is “only” 4.4% on the bottom 20%, and 0.6% on the top 1%, which is 38% and 9% respectively of their tax totals. Still, general sales taxes are 4.3 times as big a portion of the taxes paid by those on the bottom, compared to those on the top. So raising those taxes will fall that much harder on the poor compared to the rich.

Paul Rosenberg

Paul Rosenberg is not a dirty hippy. He bathes once a month, whether he needs it or not. An erstwhile programmer, he was a freelance op-ed and book review writer from 1994/96 to 2002, and has been a staff writer & editor at Random Lengths News, an alternative bi-weekly in the Los Angeles harbor area from 2002 to date. His October 2002 story “Iraq Attack-The Aims and Origins of Bush’s Plans” shared the Project Censored #1 Censored Story award for 2004.

2 Responses to Taxing the Poor to Balance the Budget in Georgia

Recent Comments

- Kucuka.net on Intellectual Property is a bad thing.

- evgeniy levchenko datums aangemeld on Debt slavery is a natural consequence of unregulated capitalism

- best career counselor on What will it take to address the climate emergency

- hyip on Debt slavery is a natural consequence of unregulated capitalism

- Tony Williams on Debt slavery is a natural consequence of unregulated capitalism

Blogroll

- 4dancers

- Aaron Krager

- Amygdala

- Autonomy for All

- Away Point

- Blue Jersey

- Bluemars

- Brad Blog

- Campaign for America's Future

- Cassandra Files

- Clear It with Sidney

- Cogitamus

- Crooks and Liars

- Cucking Stool

- Daily Show with Jon Stewart

- Dirty Hippie Sports Talk

- Disaffected and It Feels So Good

- Dispatches from the Culture Wars

- Dork with a Nerd Rising

- Eastern Sunz

- Florida Progressive Coalition

- Focal Points

- FOK News Channel

- Frederick Clarkson

- Frustrated Teacher

- Greatscat!

- HandPicked Nation

- Jazz from Hell

- jazz89 KUVO Public Radio

- Kenneth J. Bernstein

- La Bloga

- Lee Camp

- Litbrit

- Live Free or Die Alliance

- Live from the Left Coast

- MarioWire

- Media Matters

- Merge Left

- Mind Potion Radio

- MPA Political

- New York Communities for Change

- Nuclear Diner

- Political Carnival

- Progressive Leadership Action Network

- Progressive PST

- Radio or Not

- Republic Report

- Scholar as Citizen

- Scholars and Rogues

- Seeing the Forest

- Smirking Chimp

- Smoking Politics

- SomaFM

- Somos Tejanos

- Speak Out California

- Spedwybabs

- Spocko's Brain

- Stark Reports

- StarTalk

- Suburban Guerilla

- Symphony of Science

- Talk to Action

- thereisnospoon

- Today's Workplace

- Truth Vigilante

- Waking from the American Dream

- Worldwide Hippies

- WTF Is It Now?!?

- Error: Could not open handle for fopen() to http://heyhippies.tumblr.com/api/read?num=2

CALENDAR

February 2026 M T W T F S S « Apr 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 Category Cloud

Activism Americans Barack Obama Blogging Budget Bush II Administration Business Capitalism Class Warfare Congress Conservatives Corporatism Corruption Democracy Democrats Dirty Hippies Economy Education Elections Extremism Government Greed Health Care Jobs Journalism labor Media messaging Obama Administration Politics Progressives Religious Right Reproductive Rights Republicans Satire Social Security Taxation Tea Party Uncategorized Unions US Politics Violence Wall Street Wealth Wisconsin

Yes, tax structures in the states are very regressive. Just look at the inverse relationship between the red bar (s&e taxes) and the blue bar (income). Eye-popping!

Look at Illinois. The state tax is the same no matter what your income is. No progressive tax structure. A flat-tax hell.

Nice diary Paul.

PS. I finally managed to drop by your new place! Looks nice!

PS. oops, I see you haven’t posted in a while. anything new Paul?